The future of work is also on our blog

Do you work as a freelancer and are you looking to increase your income? Wage portage is a solution that may interest you. Indeed, portage allows the self-employed to benefit from several advantages, particularly in terms of social security contributions and taxes. Find out how freelance administration can help you increase your income as a freelancer.

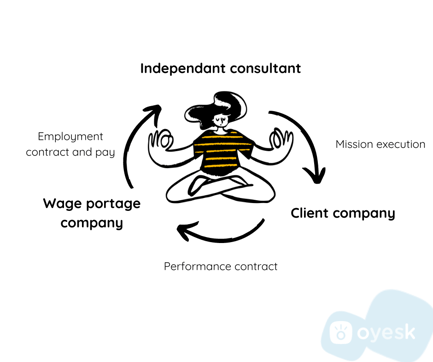

First of all, it is worth recalling the principle of freelance administration. This system is based on a so-called tripartite relationship between three actors: the independant, the client company and the portage company. The portage company acts as a bridge between the first two parties. In order to understand this system more easily, we offer you an explanatory diagram.

Moreover, freelance administration is suitable for many profiles :

jobseekers wishing to find a professional activity

young graduates looking for experience

workers looking for professional retraining

etc.

and many sectors of activity :

consulting

SEO

development

copywriting

graphics and design

other intellectual professions

meeting several needs :

income supplementation

maintaining the protections inherent in salaried employment

entry into independence without taking risks

However, regulated professions are excluded from the freelance administration system: architects, lawyers, accountants, doctors, etc.

Freelance administration can enable you to increase your income in many ways. First of all, you can benefit from significant advantages such as the smoothing of your income over the year, the reimbursement of professional expenses, the management of your contributions, etc. In some freelance administration companies, you can even benefit from a health insurance scheme, life insurance, luncheon vouchers and many other advantages usually enjoyed by traditional employees.

Moreover, by switching to freelance administration, you will no longer need to manage your contributions and invoicing yourself. The wage portage company takes care of everything: payslips, payment of contributions, etc. So you won't have to worry about any unpleasant surprises that you might have had if you had done it yourself. And as a bonus, this service is included in your freelance administration contract, so there's no need to call on an external accountant, which is always a bonus.

With freelance administration, you can also build up a financial reserve, corresponding to part of the turnover received from your assignments. This reserve, included in your activity account, can enable you to anticipate periods of inactivity that may occur in your career. In this way, you benefit from additional security and peace of mind during these periods, which can be difficult for many self-employed people. Note that you can also use this reserve at any time according to your needs.

As a self-employed person, and more particularly in freelance administration, you have to find your assignments yourself, even if some freelance administration companies can offer you assignments from time to time according to the needs of their partner companies.

Finding clients is therefore essential to increase your income, and there are several solutions available to you to do this:

Create a portfolio to showcase your skills and your work

Register on platforms dedicated to freelancing

Prospecting with companies that often use freelancers

Build a network of contacts

Join a network of freelance partners

In order to increase your chances of finding your next assignment, don't hesitate to use the network of your portage company. Indeed, some of them have a vast network of companies that regularly recruit freelance consultants for various assignments.

To increase and optimise his income, the ported employee has several solutions at his disposal. First of all, they can increase their average daily rate, depending on their expertise, their accumulated experience and their operating costs. For example, a graphic designer using professional hardware and software will have a fairly high average daily rate due to his operating costs. The portage employee can also request a salary smoothing from the portage company in order to stabilise his financial situation.

With some portage companies, you can also benefit from advantages such as luncheon vouchers, gift vouchers, holiday vouchers, universal service vouchers (CESU) etc., which will increase your income. So don't hesitate to ask for information. So don't hesitate to find out about the benefits offered by the portage company you are interested in.

You should also consider finding out about certain systems set up by certain companies, namely the employee savings plan (PEE) or the collective retirement savings plan (PERCO). These savings plans can help you secure your financial situation and your future. However, some schemes may not be suitable for your situation, so check with your client company beforehand if you wish to take advantage of them.

Finally, think about making the most of your mission expenses, travel expenses and other expenses incurred in the course of your activity. Indeed, some missions generate expenses that you can deduct:

transport tickets: train, bus, metro

transport costs: tolls, fuel, parking, taxis

accommodation costs

catering costs.

Some professional expenses are reimbursed by the portage companies. These are received at the same time as the monthly salary and are not taxable or subject to contributions, thus increasing your net pay. You can therefore rely on your umbrella company to optimise your income in full compliance.

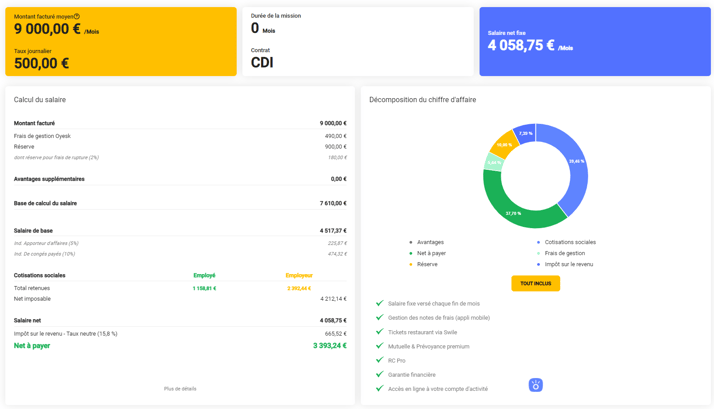

As the income of the ported employee is calculated on the basis of his turnover before tax, it is also linked to the amounts invoiced by him. Although the invoicing is done freely by the self-employed person, it must not go below a certain amount. In order to have a good basis for calculating the income, several elements have to be taken into account.

Management fees: the umbrella company charges a fixed or variable commission for all the services provided to the employee: management of administrative formalities, accounting, etc. These management fees can represent up to 10% of your turnover, while some companies opt for a fixed fee regardless of the amount of turnover.

Social security contributions : once the management fees have been deducted, the social security contributions follow. These charges relate to holiday pay, insurance, unemployment and pension contributions, etc. Once these charges have been deducted, you get your net salary.

In order to have a more precise idea of the income you could obtain through freelance administration, some freelance administration companies offer income simulators to give you a fairly accurate idea of what your income will be as a freelance employee. The simulator takes into account

your average daily rate (ADR) or your net monthly salary

the duration of your assignment

the reserve you wish to build up

whether you wish to obtain meal vouchers

So don't hesitate and contact an oyesk advisor to find out more about your potential future remuneration.

The question of the best umbrella company is a tricky one, and the answer will vary from one freelancer to another and will depend mainly on your needs. For example, some freelancers will prefer a fixed fee while others will prefer percentage-based fees. Others will prefer a portage company offering mutual insurance A or mutual insurance B. Everything will depend on your individual needs and the priority you give to them. You can therefore list all the benefits you would ideally like to enjoy, prioritise them and finally compare the offers made by the portage companies.

Here are a few things you might want to consider:

Management fees (fixed or percentage of turnover)

Social benefits offered: mutual insurance, life insurance, provident fund, etc.

Financial benefits offered: luncheon vouchers, works council, gift vouchers, holiday vouchers, etc.

Possibility of carrying out an assignment abroad

Individual support

Administrative procedures taken care of

Possibility of remote work

Level of experience of the portage company

We also recommend that you contact the umbrella companies that offer the advantages you are looking for directly, either by requesting a demo or by making a phone appointment. Although this process can be time-consuming, it is necessary for you to find the umbrella company that will meet all your needs.

Want to know more about wage portage with oyesk ?

To go further :

Employment, wage portage, freelancing: the complete comparative overview

Why is the wage portage scheme suitable for young graduates ?

What is the difference between wage portage and temping ?

Passionate about video games and movies, Lucie sharpens her pen on the oyesk blog while building his 360° communication strategy!

Contact us15, rue de l'industrie L-8069, Bertrange, Luxembourg

contact@oyesk.com

+33 3 52 84 03 06

+352 28 77 34 50